AAPL 169.89 0.5147% MSFT 399.04 -2.4495% GOOG 157.95 -1.9553% GOOGL 156.0 -1.9669% AMZN 173.67 -1.6535% NVDA 826.32 3.7087% META 441.38 -10.5613% TSLA 170.18 4.9652% TSM 136.58 2.7149% LLY 724.87 -1.0011% V 275.16 0.0509% AVGO 1294.42 2.9917% JPM 193.37 0.1502% UNH 493.86 1.3462% NVO 125.79 -0.2933% WMT 60.21 0.5679% LVMUY 167.91 -2.1618% XOM 121.35 0.2478% LVMHF 837.0 -2.6461% MA 462.11 -0.0843%

Cleveland-Cliffs Inc

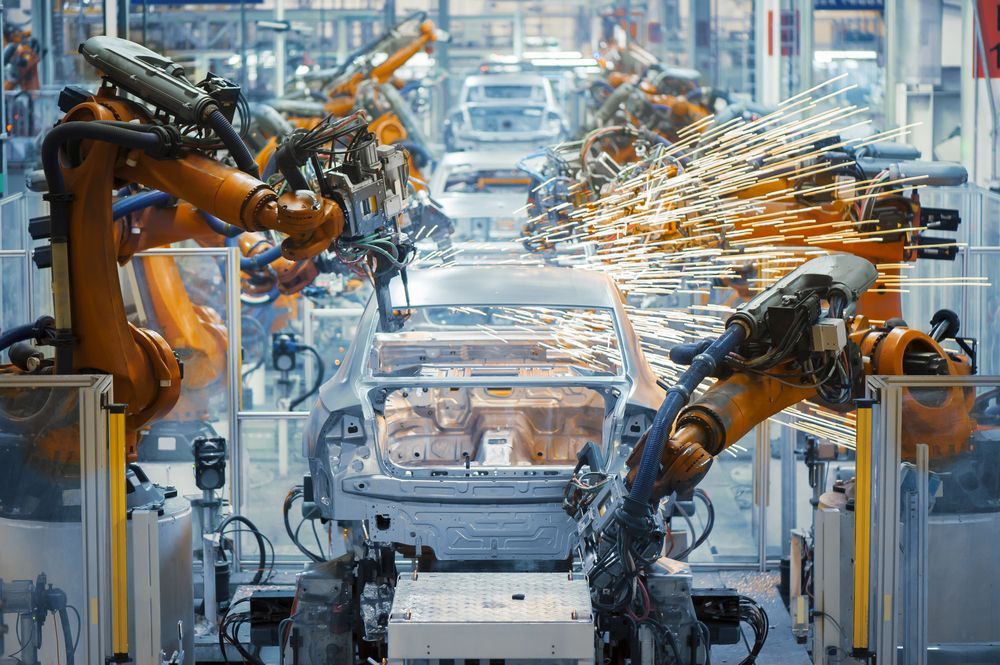

Founded in 1847, Cleveland-Cliffs Inc (NYSE: CLF) produces flat-rolled steel in North America. It is also the largest supplier of the automotive industry in North America.

Investment Highlights – BUY at USD 23.57

Key Risks

Recent News

Redemption of Shares: On 28 July 2021, CLF completed the redemption of all outstanding preferred shares with nearly US$1.2 billion in cash.

Q2 FY21 Results for six months ended 30 June 2021 (as on 22 July 2021)

(Source: Company Website)

One Year Share Price Chart

(Data Source: REFINITIV, Analysis done by Kalkine Group)

Valuation Methodology: Price/Cash Flow Approach (FY21) (Illustrative)

Conclusion

Following the strong trading performance in Q2 FY21, the outlook for FY21 looks bright. In Q3 FY21, adjusted EBITDA is expected to be nearly US$1.8 billion, while free cash flow generation is anticipated to be around US$1.4 billion. The Company has been capitalizing well on the market opportunities and meeting the elevated demand with production ramp-up and operational efficiency. The high steel prices shall support the growth and generate substantial value for its shareholders. The stock made a 52-week high and low of USD 25.83 and USD 5.20, respectively.

Based on the record revenue growth, substantial net income, financial guidance, reduced share dilution, favourable steel prices, supported by the valuation conducted above, we have given a "BUY" stance on Cleveland-Cliffs Inc at the current market price of USD 23.57 (as of 3 August 2021, at 9:40 AM ET), with lower double-digit upside potential based on 4.56x Price/NTM Cash Flow (approx.) on FY21E Cash Flow Per Share (approx.).

*All forecasted figures and Industry Information have been taken from REFINITIV.

*Dividend Yield may vary as per the stock price movement.

*The reference data in this report has been partly sourced from REFINITIV.

*Depending upon the risk tolerance, investors may consider unwinding their positions in a respective stock once the estimated target price is reached or if the price closes below the support level (indicative stop-loss price).